17 NEW Telemedicine Codes in 2025

The American Medical Association’s CPT Editorial Panel approved 17 new telemedicine service codes during 2023 for inclusion in the 2025 Medicare Physician Fee Schedule. Medicare finally announced these changes in the 2025 proposed rule on July 10, 2024.

Despite the creation of these 17 new telemedicine codes by the AMA, Medicare reimbursement is bound by a statutory requirement under the Social Security Act:

section 1834(m)(2)(A) of the Act expressly requires payment to the distant site physician or practitioner of an amount equal to the amount that such physician or practitioner would have been paid had such service been furnished without the use of a telecommunications system. This means that we must pay an equal amount for a service furnished using a “telecommunications system” as for a service furnished in person (without the use of a telecommunications system).

As the final rule reads, Medicare will include 16 of the 17 new codes in the 2025 fee schedule with a status indicator of “I” (all but 98016). In Medicare’s words this means:

that there is a more specific code that should be used for purposes of Medicare, which in this case would be the existing office/outpatient E/M codes currently on the Medicare telehealth services list when billed with the appropriate POS code to identify the location of the beneficiary and, when applicable, the appropriate modifier to identify the service as being furnished via audio-only communication technology

This means that 16 of the 17 new telemedicine codes will be treated by Medicare the same way as the physician consult codes (99242-99255) that also appear on the Medicare fee schedule with a status indicator of “I”. Both the consult codes and 16 of the new telemedicine codes are NOT reimbursed by Medicare.

If implemented, the overall Medicare reimbursement impact of the 17 new telemedicine codes would have been negative. Generally, physician telemedicine services would have experienced a 20% to 30% decrease in Medicare reimbursement when provided in office-based settings. Telemedicine services provided in facility settings, like hospitals, would have experienced only a 5% to 10% decrease in physician reimbursement because work RVU were mostly unchanged.

17 NEW Telemedicine Codes: 2025 Medicare Physician Fee Schedule Proposed Rule

2025 Commercial Telemedicine Reimbursement

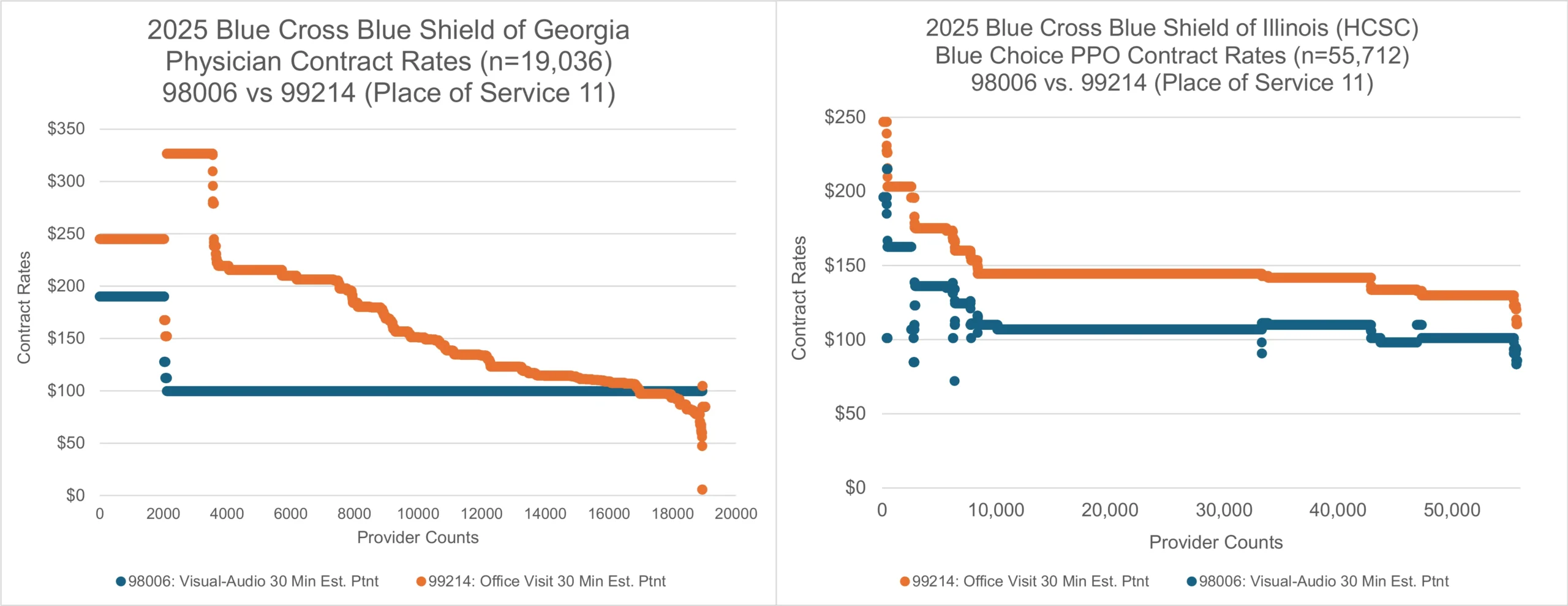

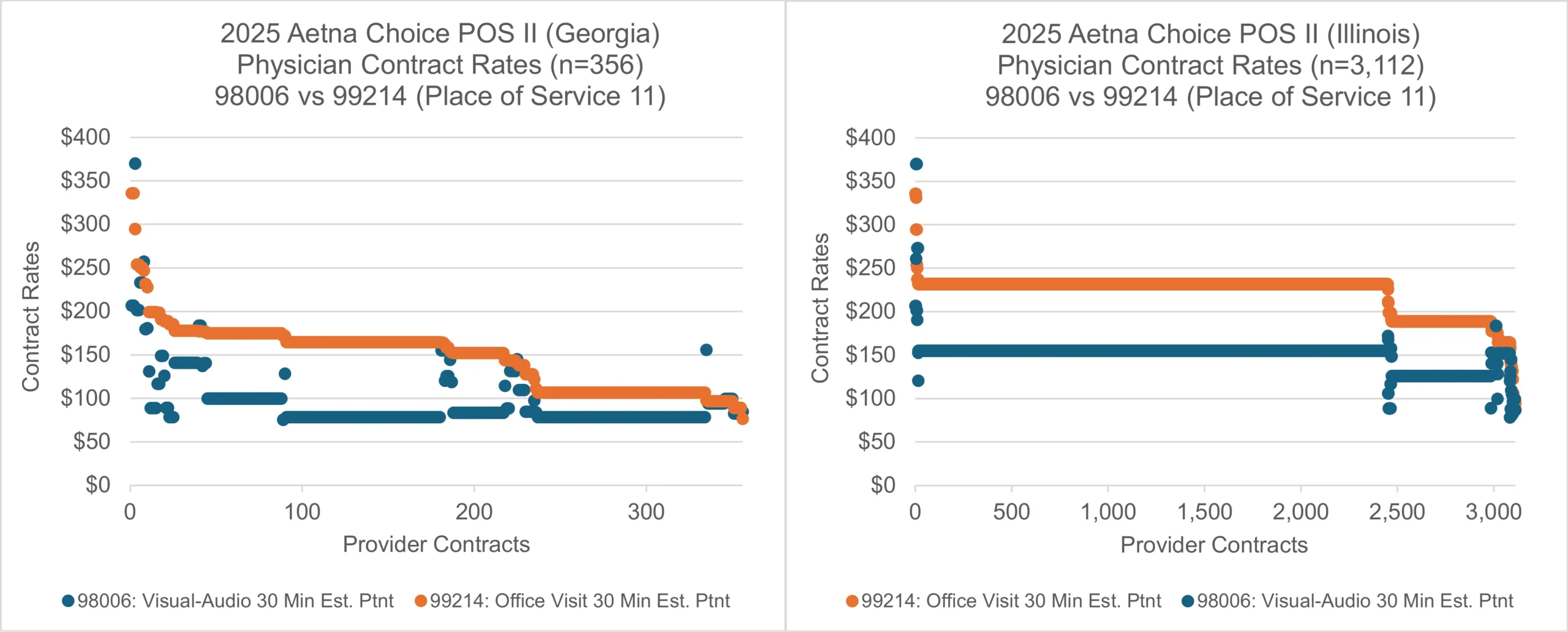

Commercial health insurance carriers are not subject to the statutory and geographic telemedicine restrictions of Medicare. Major commercial insurance carriers across the U.S. are indeed using the 17 new telemedicine codes. These commercial insurance carriers are setting reimbursement rates based on the unused Medicare telemedicine codes just like they sometimes do for the unused Medicare consult codes (99242-99255). For example, Blue Cross Blue Shield carriers in the states of Georgia and Illinois have set telemedicine reimbursement rates much lower than their in-office counterparts–averaging 29% and 24% lower reimbursement, respectively (see charts below). Aetna carriers in Georgia and Illinois have set telemedicine reimbursement rates much lower than their in-office counterparts–averaging 34.6% and 32% lower reimbursement, respectively. The charts below exhibit the difference in reimbursement between 98006 (audio-visual telemedicine visit, 30 minute, established patient) and 99214 (in-office visit, 30 minute, established patient) as contracted with the same medical physicians.

A 24% to 34% decrease in reimbursement for telemedicine services has serious implications for these services. These disparities for Blue Cross Blue Shield and Aetna plans in Georgia and Illinois may not be representative of all services for all commercial carriers in all states. The difference between reimbursement for in-office and telemedicine services is much more variable for carriers like UnitedHealthcare. The charts above illustrate this relatively higher level of variability from provider to provider.

Medical providers and groups that provide patient care through telemedicine channels should benchmark reimbursement rates for all commercial carriers in their local markets. Finance, operations, and managed care professionals should discuss the implications of these changes on their service operations and contracting strategies.

See what Blue Cross Blue Shield, UnitedHealthcare, CIGNA, Aetna, Kaiser, and other commercial payors pay for telemedicine services in your market.