Hospice Business Valuation

The hospice service industry has experienced unprecedented year-over-year growth. Many major hospice markets have doubled in size. These growth trends impact hospice business valuations in a big way.

Demand for hospice services has doubled during the past five years in many major U.S. markets. Moreover, there are now major hospice agencies in many markets that did not have any hospice services five years ago. Even very large markets, like Phoenix and Indianapolis, have experienced double-digit growth year-over-year. This is an impressive feat for such an established industry.

Over 700 new Medicare-certified hospice agencies collectively opened during 2022 and 2023. To investigate this explosion of new service providers, the Centers for Medicare and Medicaid Services enacted a period of enhanced oversight for all new hospices in Arizona, California, Nevada, and Texas beginning during the summer of 2023.

Below are three things you should know when getting a hospice agency business valuation.

Native Video Player

Hospice Business Valuation: Unprecedented Growth

YouTube Video Player

#1: Long-Term Growth Rates Are Data-Driven

Medicare cost report data for all the hospice agencies in your market is publicly available for the past five years. By pulling market volumes and revenues for every hospice agency that files annual Medicare cost reports, we can identify exactly how fast your market is growing, and your position in the market.

The chart below shows total hospice agency net patients service revenues for 10 major U.S. markets between 2018 and 2023. The 10 major markets below all grew between 50% and over 100% during the past five years.

This long-term growth trend impacts business valuations of hospice agencies. The long-term earnings growth rate of a hospice agency is a major variable whether a business appraiser uses the Capitalization of Earnings method, a Discounted Cash Flow analysis, or both.

Conservative business appraisers often project long-term growth rates of 2% to 3% for many types of healthcare businesses. This practice is absurd in a hospice market like Phoenix, Arizona, that has grown 25% or more during three of the past five years.

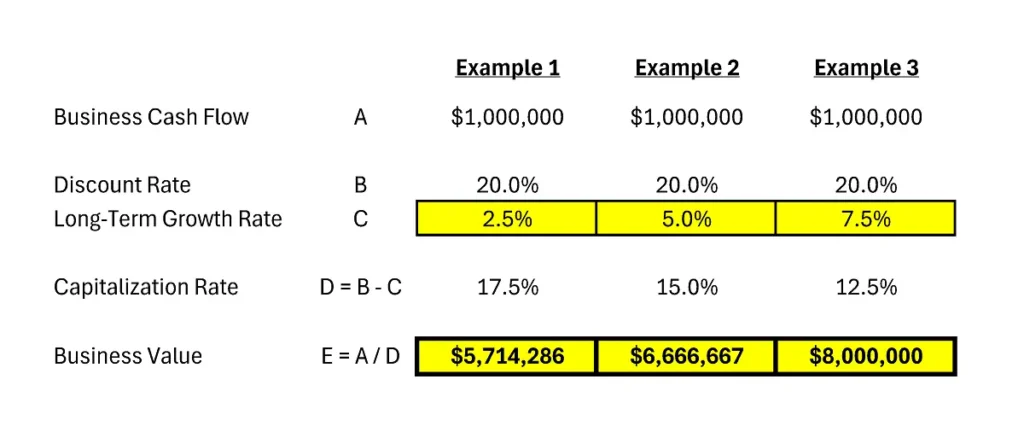

The long-term growth rate has a direct impact on the Gordon Growth Model formula used to calculate business value. The example calculations on the screen compare the impact of long-term growth rates of 2.5%, 5.0% and 7.5% on the same business valuation. For a small hospice agency, a 2.5% difference in the long-term growth rate has about a $1 million impact on valuation.

Examples:

Impact of Long-Term Growth Rate on Hospice Valuation

If you are involved in a hospice business valuation, make sure to press your appraiser to pull the Medicare Cost Reports for all hospice agencies in your market for the past 5 years. Verifying the long-term growth rate of your market will have a meaningful impact on your hospice business valuation.

#2: Financial Ratio Comparables

Impact DCF & Working Capital Adjustments

Hospice business valuations are heavily impacted by financial ratio analysis. Financial ratio adjustments can have substantive impacts that increase or decrease your business value.

Credible hospice business valuations require directly comparable financial ratios from at least a few dozen other hospice agencies just like yours. Ideally, these will be hospice agencies that are the same size and market as yours.

Example ratios include your days of expenses held in cash on hand, accounts receivable ratios like days of sales outstanding, debt and liability ratios, and various expense ratios, including staffing and labor ratios.

Below are just two of several types of financial ratios Coker queries when valuing a hospice agency.

Example Financial Ratios Data

Days of cash on hand, days of sales outstanding, and direct labor costs per visit are the types of financial ratios that can determine whether or not normalizing adjustments will be made, how much to adjust value, and whether those adjustments will increase or decrease your business value.

Using Medicare cost report filings, we can identify the very best comparable agencies for benchmarking. We can search over 4,000 U.S. hospice agencies to find those that are the same size and located in the same or similar markets.

#3: Get value for hospice CONs, moratoriums,

state licenses, & Medicare certification

Hospice agencies are subject to many different reimbursement and regulatory factors. If your state has a moratorium, a Certificate of Need program, or other special startup requirements like a minimum level of cash on hand, all those are high barriers to entry for competition.

At a minimum, high barriers to entry for competition should be factored in the company-specific risk premium (CSRP) of your business valuation’s discount rate build-up to increase your business value.

In some markets, just the empty shell of a hospice agency with a Certificate of Need, state license, and Medicare certification could be worth anywhere from a quarter million dollars to one million dollars, or more.

We have been preparing hospice valuations for 20 years.

Hospice has been near and dear to my heart since 2005, when I valued a small home health and hospice agency in rural Indiana. Since 2005, I have worked with hundreds of hospitals and surgery centers, as well as thousands of physicians. My whole healthcare career started with one small rural home health and hospice agency valuation.

-Nicholas Newsad, MHSA