Physician Practice Start-Ups:

Cash Flow Pitfalls During Your First Year

The most fragile time for a new physician practice is the first 12 months. There is really no room for error during your first year. Like any business, you must master your cash flow to survive.

Unfortunately, you can be profitable on paper and still run out of cash. That is why accountants and finance professionals often say “cash is king”. This article identifies keys to cash flow that will make or break a startup physician practice.

Native Video Player

Physician Practice Start-Ups: Cash Flow Pitfalls During Your First Year

YouTube Video Player

Payor Credentialing

Physicians must recredential with insurance carriers any time they switch from one group to another with different tax identification numbers (EIN numbers). Insurance credentialing can take 60 to 90 days for each insurer plus another 30 days or more for contracting. This can leave you sitting idle, forced to turn away prospective patients, while you wait for paperwork to process.

What’s worse is that Medicare and a few other insurance carriers require a physical office space to be credentialed, so you get to pay rent while you wait.

There are creative ways to minimize the credentialing gap. We recommend working with a healthcare attorney before you take the leap to brainstorm ways to get a head start on the insurance credentialing and contracting process.

Accounts Receivable

Since cash flow is so important, we recommend outsourcing medical billing to a reputable and credible billing firm during your first year. Athena Health has competitive billing fees for physician practices from 4% to 6% of collections, and they provide their own integrated billing software system and Electronic Health Record (EHR) system.

The alternative is to hire your own professional billing employees, purchase your own billing and EHR software systems, and contract with a claims clearinghouse. There is a modest chance that the billing professional(s) you hire will not work out. This can leave you scrambling to find replacements in a mad rush to keep precious cash flowing during your first year.

Also, this should go without saying, but patient copays, deductibles, and coinsurances must be collected at the time of service. Once patients walk out your door, the time and cost to collect those patient balances increase fifty-fold.

Marketing

Patients are not going to magically line up at your door. You are going to have to do some marketing. Entrepreneurs cannot afford to waste money on marketing that does not work. Here are three types of marketing that we know work for sure.

Advertising

We are not fans of pay-per-click advertising (Google Adwords, Facebook) for physician practices. You can run up thousands of dollars in bills on clicks that yield absolutely no patients at all.

We are big fans of patient scheduling services like ZocDoc that put real patients on your schedule. Many of the mega-health system physician groups are booking patient appointments out 6 to 12 weeks in the future (or more). Patients who think this is ridiculous (because it is) are dropping providers like bad habits when they realize they can schedule an appointment tomorrow through ZocDoc.

Considering the lifetime value of a new patient, the ZocDoc fees are miniscule. Patients who schedule through ZocDoc are looking for providers who have time to see them right away. That could be you.

Referral Marketing

The federal Anti-Kickback Statute and Stark Laws are quite serious. You should never provide a referral source with anything of value in exchange for patient referrals.

Fortunately, face-to-face time is the one thing that drives more referrals than anything. If you are a specialist, make a point to physically introduce yourself to all the prospective referral sources in your immediate area. Call ahead to schedule a brief time to stop by to make your brief introduction.

You will be shocked at how effective simple face-to-face introductions are at generating referrals. This is because almost no one does them anymore. The best part is that they do not cost you anything.

Call Coverage

Depending on your specialty, you can draw new patients by taking call coverage at local hospitals. Not every patient you get called for is going to be a patient you want, but you should leave no stone unturned during your first year. If the payor mix is untenable, you can always terminate the call coverage contract.

Accounts Payable: Inventory & Vendor Services

Unfortunately, patients and insurance companies are not going to pay everything they owe you within 30 days. We wish they would. If you must wait to get your money, then your vendors will have to wait to get their money too.

Since you are essentially extending zero interest credit terms to patients and insurance companies, use whatever credit terms your vendors extend you to pay your bills. If you have 30 days to pay an invoice, then take full advantage of the 30 days.

It sounds like a little thing, but startup practices cannot afford to pay all their bills upon receipt AND offer extended zero interest credit to their patients and insurance customers.

Real Estate

The biggest financial issue we saw physicians suffer during the 2008 financial crisis was having too much office space. Many physicians bought and rented extra commercial real estate with the expectation that they would grow into the space over time or sublease empty office space to other tenants. It did not always work out.

A good rule of thumb is to purchase or rent no more than 1,100 square feet of office space per physician. Bursting at the seams is a much better problem to have in comparison to having too much office space.

There are great professional office space brokers like Ally Medical Partners and CARR that specialize in negotiating medical office space for professionals.

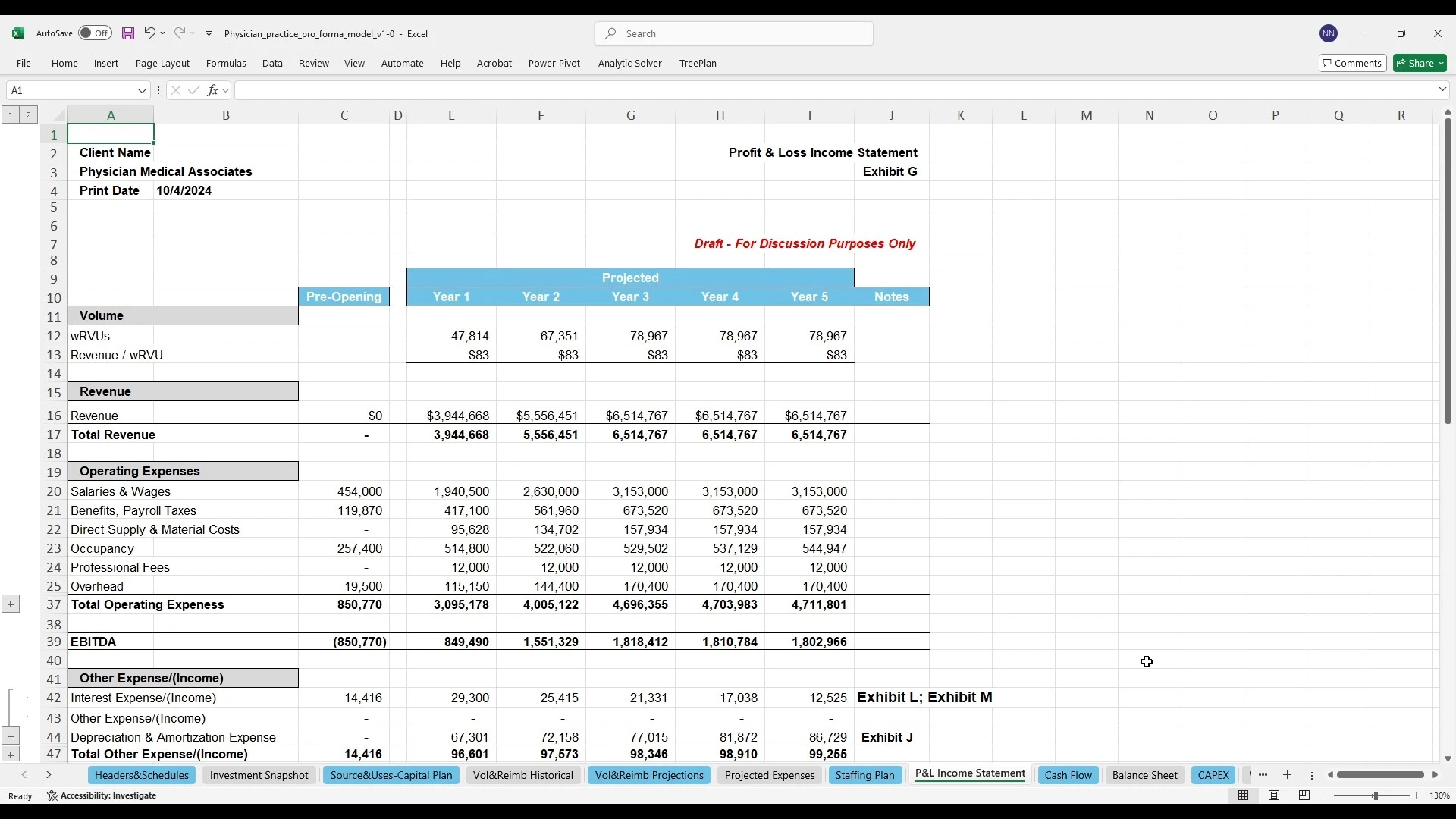

Physician Practice Pro Forma Financial Model

If you are borrowing money or raising investment, then lenders and investors will want to see some financial projections.

Health-Contract.com is offering its Physician Practice Pro Forma Financial Model subscription at 33% OFF for a limited time. This is an Excel model that helps you eliminate tens of thousands of dollars of consultant fees by putting together your own financial projections. This model takes basic volume and expense inputs and generates all three standard financial statements for lenders and investors.

Checkout the demo videos below and read more on the Physician Practice Pro Forma Financial Model product page.

Native Video Player

Physician Practice Pro Forma Financial Model

YouTube Video Player

Health-Contract.com's principals have been preparing healthcare pro forma financial models since 2005

Entrepreneurs are Health-Contract.com’s core customers. Since 2005, I have prepared hundreds of pro forma financial models for ambulatory surgery centers (ASCs), endoscopy centers, imaging centers, acute and surgical care hospitals, physician practices, and home health and hospice agencies.

Please watch the video demo for our Physician Practice Pro Forma Financial Model and contact us directly with any questions.

–Nicholas Newsad, MHSA, Managing Partner, Health-Contract.com