National compensation surveys include a lot more in Total Compensation than just Clinical Compensation. This article explains the difference between Total Compensation and Clinical Compensation for four different physician specialties.

Native Video Player

Total Compensation vs. Clinical Compensation: What's the Difference?

YouTube Video Player

The Total Compensation metric reported by major physician compensation surveys can include much more than just Clinical Compensation from personally-performed professional services. Provider compensation professionals should be cautious to not accidentally violate the Stark Law by relying solely on Total Compensation when data is available for just Clinical Compensation.

The national provider compensation surveys, including MGMA, are explicit in identifying the definitions of Total Compensation. MGMA lists the definition of Total Compensation publicly on its website.

The amount reported as direct compensation on a W2, 1099, or K1 (for partnerships) plus all voluntary salary reductions such as 401(k), 403(b), Section 125 Tax Savings Plan, and Medical Savings Plan. The amount includes salary, bonus and/or incentive payments, research stipends, honoraria, and distribution of profits…

Using MGMA’s definition, Total Compensation includes guaranteed base salary, productivity incentive compensation, value-based incentive compensation, on-call pay, medical directorships, APP supervision pay, and all private practice business income included in K-1 forms. Private practice business income can include income from in-office ancillary services, profit margins on employed providers, income from investments in surgery centers, income from medical office subleases, and more.

Clinical Compensation is just one component of Total Compensation. Clinical Compensation refers to compensation for just personally-performed professional clinical services. Office visits, surgeries, and minor procedures are examples of personally-performed professional clinical services. Compensation for an administrative medical directorship, on-call coverage availability, and APP supervision is not Clinical Compensation.

Until recently, there has been no comprehensive data source for distinguishing pure Clinical Compensation from Total Compensation. This changed this past year during 2024 when DataRise Provider Compensation Data unveiled a pure data source for Clinical Compensation covering over 100 physician specialties and 250 U.S. markets.

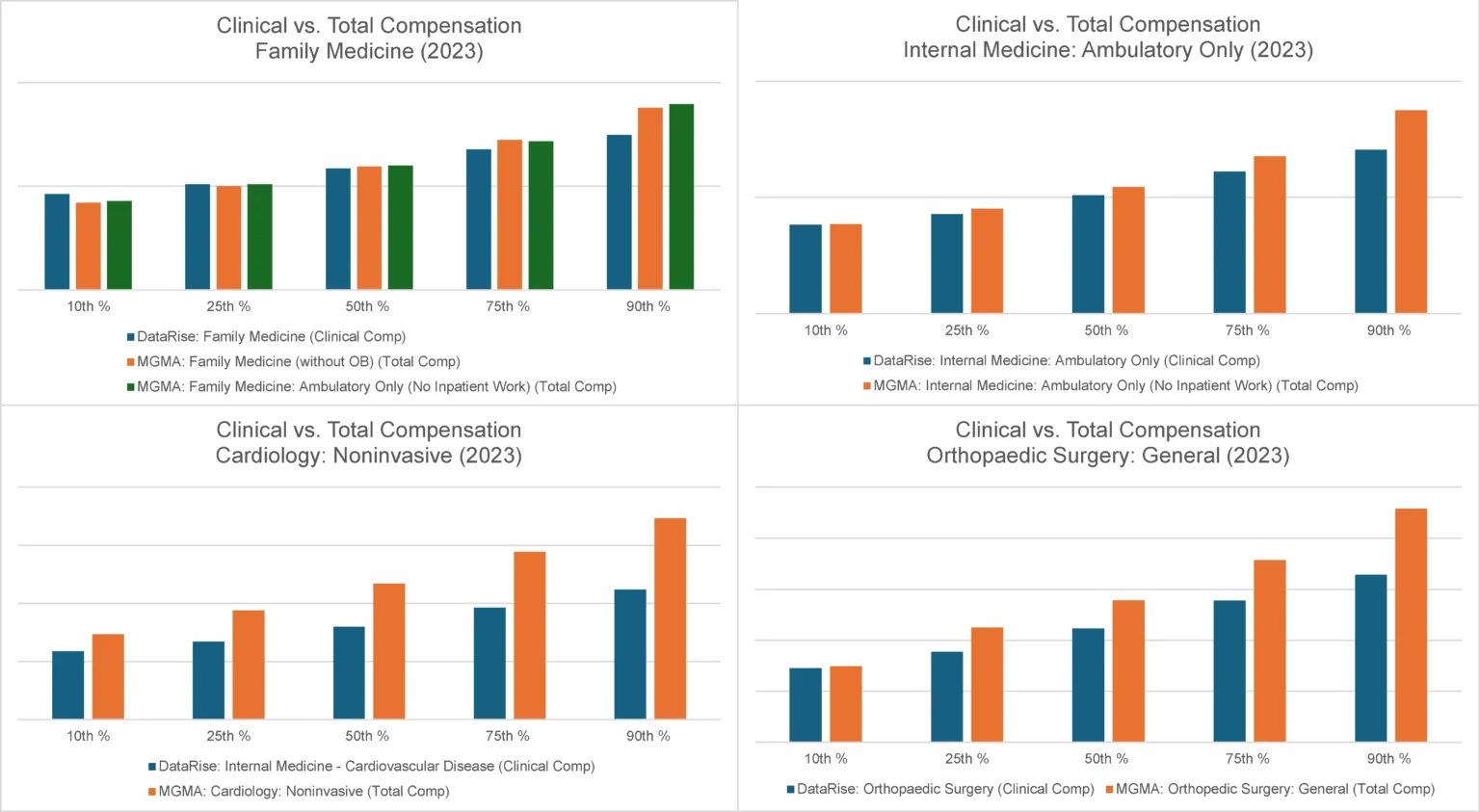

Clinical vs. Total Compensation: Four Specialties

At the national level, there is little noticeable difference between DataRise’s Clinical Compensation and MGMA’s Total Compensation data for office-based primary care specialties associated with little or no call coverage and little or no in-office ancillary services. It makes logical sense that Total Compensation and Clinical Compensation would be similar for many physicians in these office-based primary care specialties.

The differences are much more striking among surgical and procedural specialties associated with substantial on-call coverage and in-office ancillary services. Cardiology and Orthopaedic Surgery reveal substantial differences in comparisons of DataRise’s Clinical Compensation and MGMA’s Total Compensation for the same specialties.

DataRise’s developers are currently in the process of reconciling the ancillary income component of Total Compensation on a specialty-by-specialty basis. They have found that 80% to 90% of in-office ancillary income is represented by only three to four in-office ancillary services within each specialty.

This next level of reconciliation of the ancillary income component of the difference between Total Compensation and Clinical Compensation is informative, but caution is emphasized. Employers are prohibited from paying physicians for referrals to in-office ancillary services that are Stark Designated Health Services, unless the compensation is structured in conformance with an applicable exception to or special rule of the Stark Law. An expert healthcare attorney should be consulted to ensure that physician compensation plans are structured appropriately in accordance with the appropriate Stark exceptions and Anti-Kickback Statute safe harbors.

Including in-office ancillary income from Stark DHS in physicians’ compensation plans has severe penalties if the arrangements do not conform with an applicable exception or special rule. Among the Department of Justice’s many accusations against Community Health Network in Indiana, the DOJ alleged that CHN based physician compensation upon the volume and value of physician referrals to Stark DHS like imaging, diagnostic testing, and hospital services. CHN agreed to pay a $345 million settlement at the end of 2023 to resolve many of these allegations.

If you rely on Total Compensation metrics from national surveys to set Clinical Compensation, you may consider adjusting your approach. Clinical Compensation can now be isolated separate and apart from Total Compensation using DataRise’s Provider Compensation Data subscription. If you would like to share in-office ancillary income with physicians in your medical group, consult with an experienced healthcare attorney to structure your arrangements to comply with an exception or special rule to the Stark Law.

We have the data!

The DataRise™ Provider Compensation Data Platform provides personally-performed clinical compensation data for over 100 physician specialties and 250 U.S markets.

Purchase the data subscription today, or contact Coker directly for a formal Fair Market Value opinion.