Telemedicine Commercial Reimbursement Trends

The 2025 commercial reimbursement rates for telemedicine are finally here. New commercial reimbursement rates are starting to appear in payor contracts for the 17 new telemedicine codes implemented during 2025.

While Medicare still has a statutory requirement to pay telemedicine physician services at in-office rates, commercial insurance carriers are not required to follow Medicare’s mandate. We found tens of thousands of commercial physician contracts that already reflect new reimbursement rates for the new 17 telemedicine codes, including Blue Cross Blue Shield, UnitedHealthcare, Aetna, CIGNA, and other carriers.

Native Video Player

Telemedicine Commercial Reimbursement Trends

YouTube Video Player

The broad takeaway is that commercial reimbursement for telemedicine varies from carrier to carrier, from market to market, and from code to code.

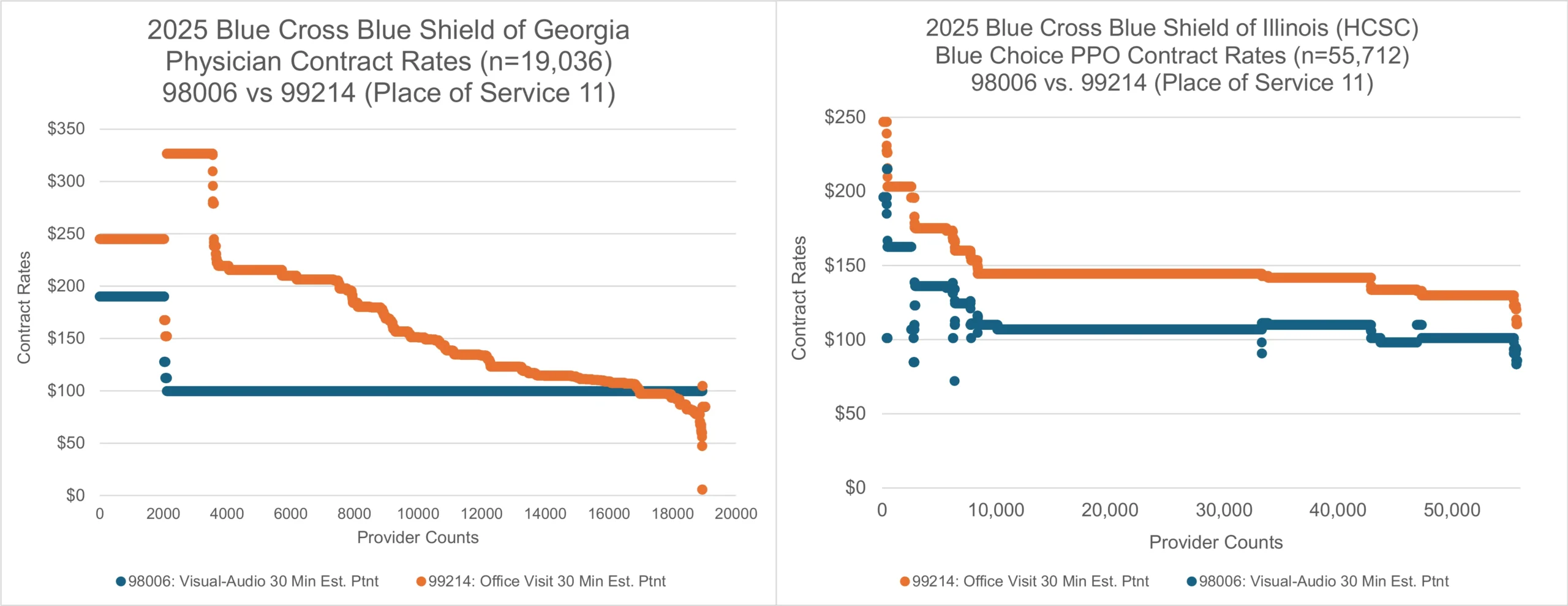

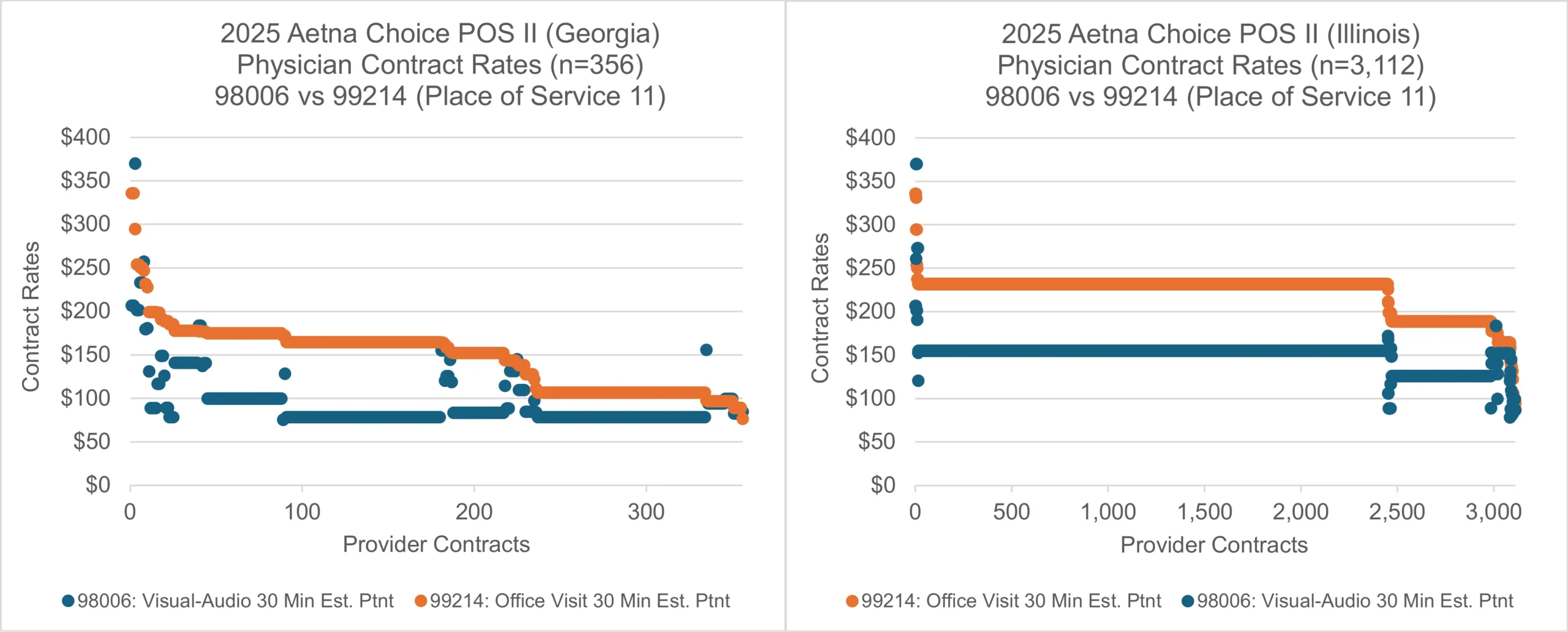

In the states of Georgia and Illinois, we compared the commercial contract rates for two evaluation and management codes. We analyzed 30-minute audio-visual telemedicine billing code 98006 and the 30-minute in-office code 99214. Both codes apply to visits with established patients.

For Blue Cross Blue Shield plans and Aetna plans in these two states, we are observing substantially lower reimbursement for 30-minute telemedicine visits in comparison to 30-minute in-office visits. Blue Cross Blue Shield reimbursement for the exact same physicians reflects an average difference of 24% to 29% between the two codes. The average difference in Aetna reimbursement for these two codes is even higher at 32% to 34%.

Telemedicine Commercial Contract Rates

Georgia & Illinois: 98006 vs. 99214

While Blue Cross Blue Shield and Aetna are demonstrating lower telemedicine reimbursement rates compared to in-office services, other payors like UnitedHealthcare and Cigna are demonstrating different trends. In many markets, we are seeing telemedicine rates for UnitedHealthcare and Cigna that are the same as or only slightly lower than in-office rates.

Telemedicine is projected to be one of the highest growth sectors of the healthcare industry over the next decade. Telemedicine reimbursement decreases from 24% to 34% will have a material impact on the business models of medical practices and groups.

Want to see what commercial carriers pay for telemedicine services in your market?

Contact Coker DataRise™ today to order custom telemedicine reimbursement data for your market.

Blue Cross Blue Shield, UnitedHealthcare, Aetna, CIGNA, and all other carriers are available