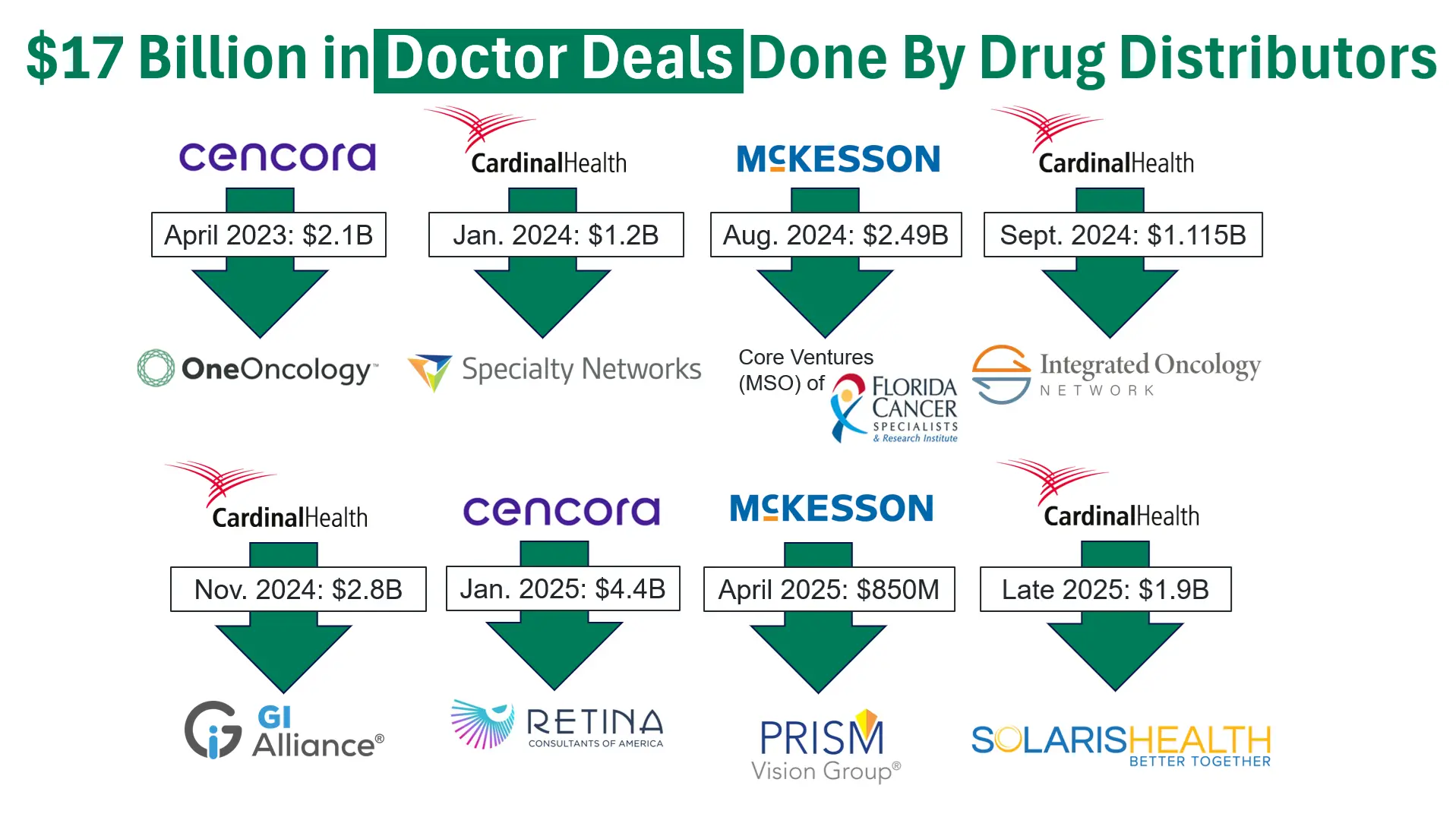

$17 Billion in Doctor Deals Done by Drug Distributors

Cardinal, McKesson, and Cencora (formerly AmerisourceBergen) have been busy during the past two years. These three drug distributors have spent over $17 billion acquiring large specialty medical groups from private equity sellers. Close review of the target acquisitions reveals a compelling business strategy involving in-office drug infusions, injections, and dispensing.

Native Video Player

$17 Billion in Doctor Deals Done by Drug Distributors

YouTube Video Player

Private equity firms have rolled up hundreds of specialty medical groups into large Management Service Organization platforms over the past decade. Some private equity firms have transcended specialization in healthcare business acquisitions to focus solely on professional medical group acquisitions.

Having successfully rolled up fragmented “mom and pop” practices into large national physician enterprises, capital partners now seek to find buyers for these large businesses. UnitedHealth Group’s Optum has completed many large acquisitions, but few expected major drug distributors to be the main buyers of large specialty medical groups. Large incumbent operators of medical groups, including HCA, Privia, and Mednax have focused on organic growth strategies rather than large acquisitions.

The physician practice management company business is not without challenges. Walgreen’s struggles with the VillageMD clinic service line arguably led to the sale of the entire Walgreens enterprise to Sycamore Partners during 2025. Envision Healthcare’s long, drawn out bankruptcy resulted in the spin-off of Amsurg and converting billions of dollars of debt to equity. Even Optum’s Sound Physicians hospitalist group has engaged turnaround consultants to help improve financial performance.

Cardinal, McKesson, and Cencora have pursued a compelling business acquisition strategy: vertical integration. Many specialty physician practices have added in-office drug infusions, injections, and in-office drug dispensing to their services. Oncology, ophthalmology, and rheumatology clearly administer and prescribe the most in-office drugs in total dollars. Gastroenterology, urology, neurology, and endocrinology also prescribe and dispense notable numbers.

Oncology

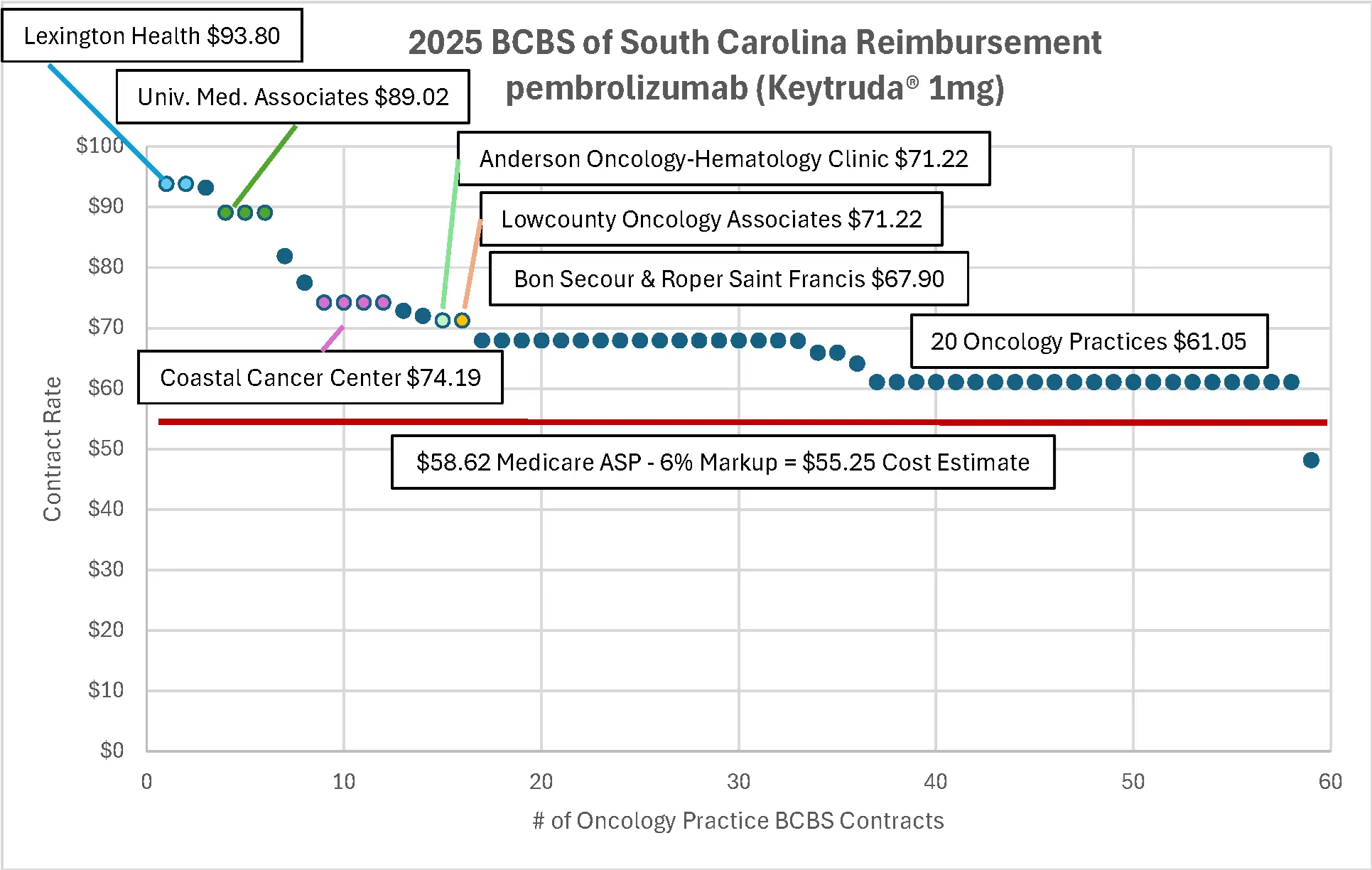

Categorically, oncology administers and prescribes the most drugs to patients by total sales. The immunotherapy drug pembrolizumab (Keytruda®) was the top selling drug in the world during 2024 and 2025. Keytruda® gained wide popularity after it was credited with saving former U.S. president Jimmy Carter’s life during 2015. After Carter’s liver cancer spread to his brain, he famously reported he was in remission after only four rounds of Keytruda® with no side effects.

The graph below details commercial reimbursement rates under Blue Cross Blue Shield of South Carolina’s health plan for 1 mg of Keytruda® when administered in-office in oncology medical groups.

Given the standard dosage is 200 mg per treatment (200 times the contract amount below), medical groups in South Carolina net between $1,100 and $7,700 for each 30-minute infusion after estimated costs. Infusions are typically given every three weeks at this dosage.

Ophthalmology

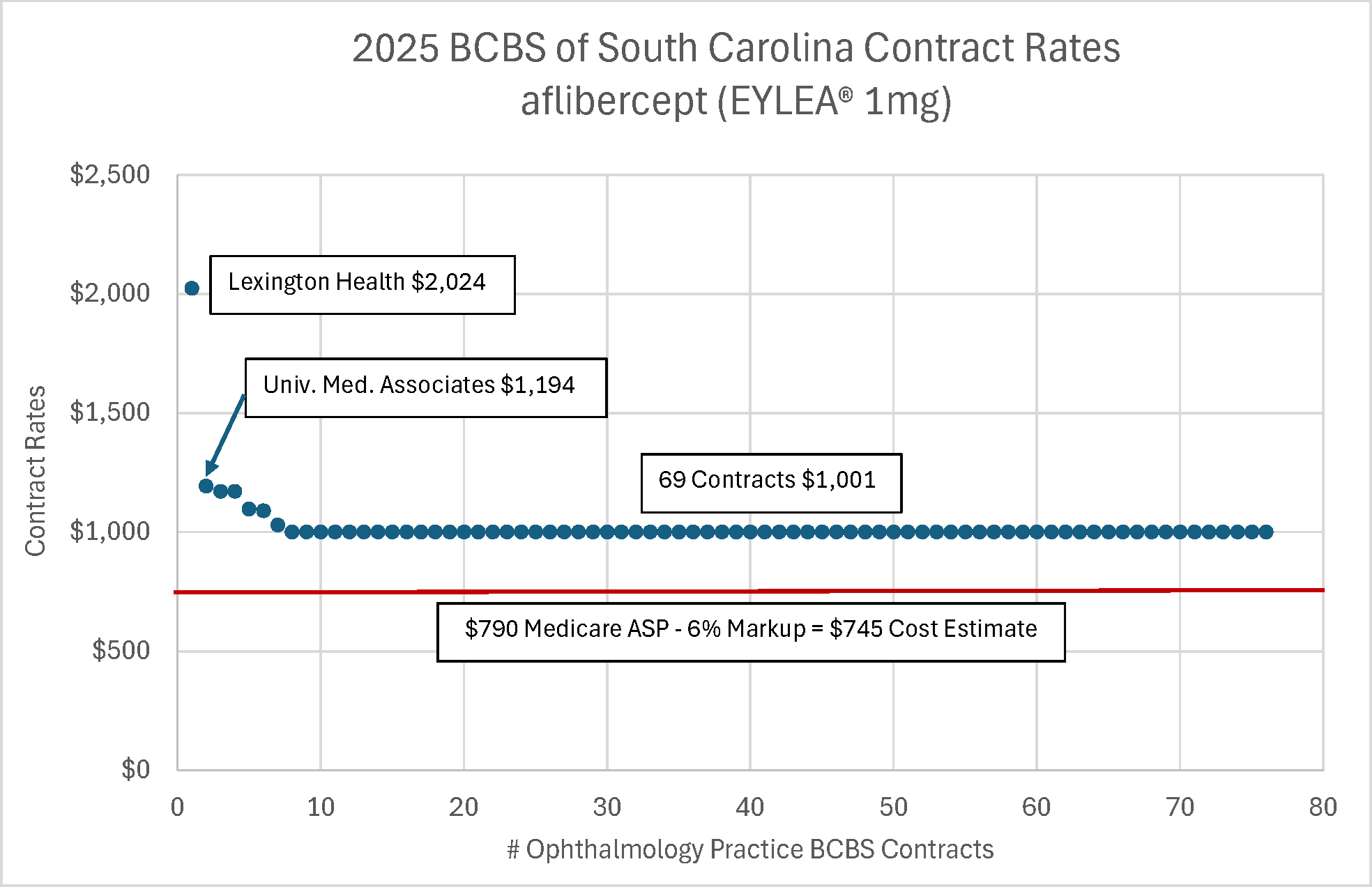

Eylea® (aflibercept) is the top drug administered by U.S. ophthalmologists in their offices by total sales. Eylea® is an injection given to patients to treat wet age-related macular degeneration, diabetic macular edema, and diabetic retinopathy.

The graph below details commercial reimbursement rates under Blue Cross Blue Shield of South Carolina’s health plan for 1mg of Eylea® when administered in-office in ophthalmology medical groups.

Given the standard dosage is 2 mg per treatment (twice the contract amount below), medical groups in South Carolina net between $500 and $2,500 for each in-office injection after estimated costs. Injections are typically given every month at this dosage for the initial three to five months. Maintenance injections are bi-monthly thereafter

Rheumatology

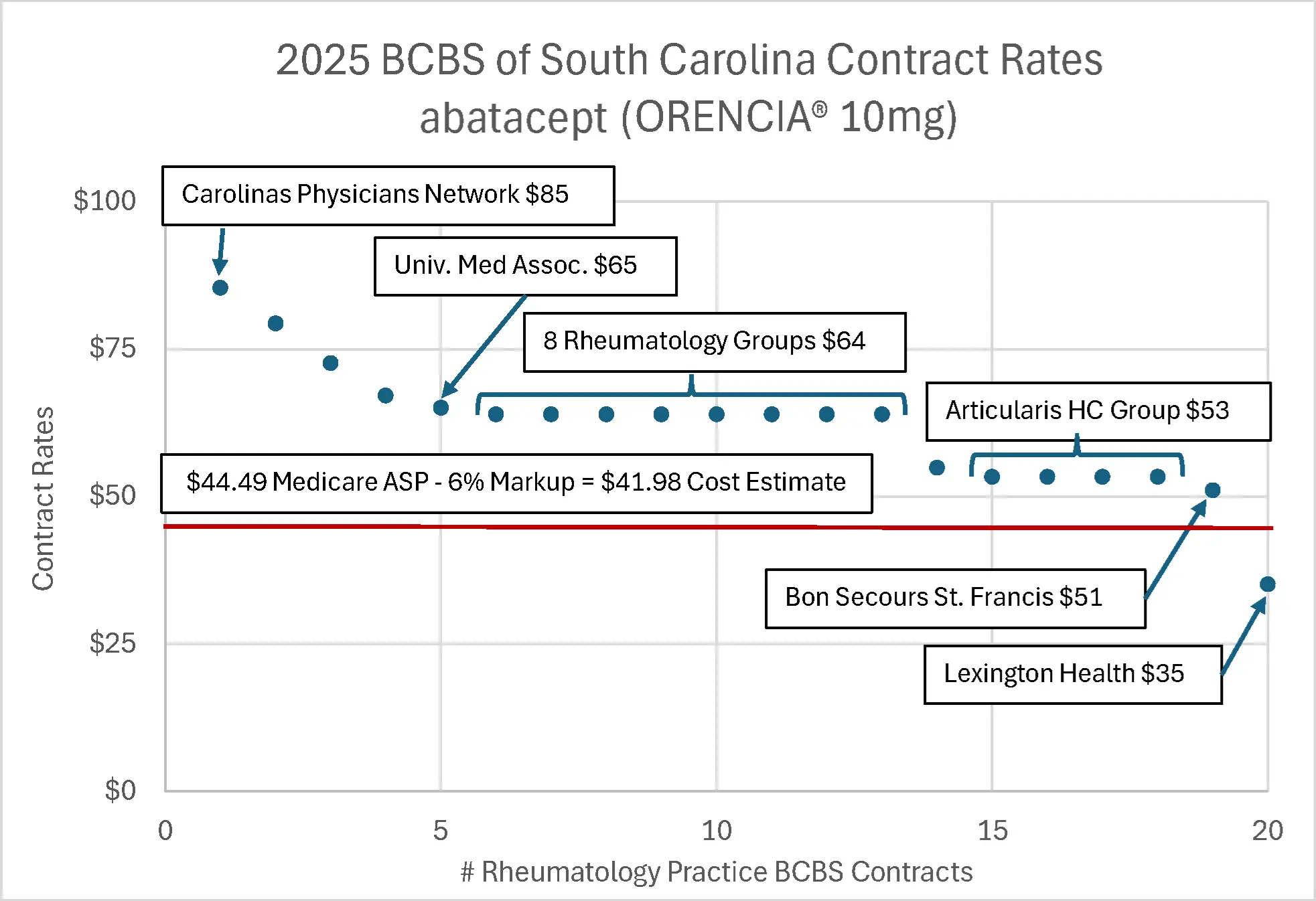

Orencia® (abatacept ) is the top drug administered by rheumatologists in their offices by total sales. Orencia® is used to treat rheumatoid arthritis, psoriatic arthritis, and juvenile idiopathic arthritis.

The graph below details commercial reimbursement rates under Blue Cross Blue Shield of South Carolina’s health plan for 10mg of Orencia® when administered in-office in rheumatology medical groups.

Given the standard dosage ranges from 500 mg to 750 mg per infusion treatment (based on patient weight), medical groups in South Carolina net between $0 and $3,250 for each in-office infusion after estimated costs. Infusions are typically given at the initial visit, again at two weeks, and then every four weeks thereafter. While some patients give themselves 125 mg injections at home, Orencia® is still the most billed in-office drug administered by rheumatologists in the U.S. by total sales.

In addition to the specialties exemplified above, gastroenterology, urology, neurology, and endocrinology also administer and prescribe large volumes of drug treatments. Some specialties do not administer and prescribe lots of specialty pharmacy drugs, and not every specialty is a good fit for this business acquisition strategy at the current time. However, the robust pipeline of forthcoming new drug therapies based on CRISPR, RNA, and immunotherapy technologies can quickly tip the scales in favor of new specialties.

The transition of major cancer treatments from inpatient to outpatient settings will also amplify the attractiveness of oncology to drug distributors. For example, the monoclonal antibody Rituximab was once commonly given inpatient to manage infusion reactions, but since around 2015, many protocols have fully transitioned to outpatient administration. Guidelines for several immunotherapies are now in the gradual process of transferring low risk patients from inpatient to outpatient treatment settings.

Want to benchmark commercial drug reimbursement rates in your market?

Interested in selling your medical practice or infusion business?

We have the data!

The Acuvance DataRise™ Commercial Drug Reimbursement Data subscription provides detailed commercial reimbursement data for drugs infused, injected, and dispensed in physician offices.

Purchase the data subscription today, or contact Acuvance DataRise™ directly to learn more.