Physician Malpractice Premiums Vary by State, Specialty & Other Factors

By Nicholas Newsad, MHSA

Physician malpractice insurance coverage is one of the most obscure and least understood parts of running a practice. Whether physicians are independent or employed, malpractice premiums can vary a lot depending on physician specialty, geography, group size, deductible amounts, and many other factors.

To prepare this featured article, we interviewed malpractice insurance expert Janel Loud-Mahany from COPIC Insurance and conducted a nationwide review of physician malpractice premiums in 20 states and the District of Columbia.

COPIC is a medical liability insurance carrier offering coverage to physicians, hospitals, and other healthcare facilities in a number of states. COPIC’s mission is to improve medicine in the communities it serves, and it develops patient safety and risk management programs and activities that reduce risk for their policyholders. COPIC is celebrating its 40th anniversary this year and is known nationally in the industry for its innovative early resolution program (3Rs Program), which was highlighted in The New England Journal of Medicine.

Janel Loud-Mahany is the Sr. Vice President of the Underwriting and Customer Support Team and serves on the Operational Council at COPIC. She joined in 2000 and her experience includes oversight of operations and underwriting of business for all types of medical professional liability coverage. In addition, she has oversight of COPIC, a Risk Retention Group, leads customer service, and is involved in COPIC’s market expansion initiatives, new market products, and business opportunities.

Risk & Malpractice Premiums

Question: What types of things can medical professionals do to reduce their risk of a claim and the amount of their premiums?

- Part-time discounts

- Claims-free discounts

- Deductible discounts

- Risk management discounts

- Administrative discounts (based upon group size)

One way to manage premiums is the appropriate selection of policy limits – although one could purchase excessive coverage limits, careful assessment of one’s actual risk exposure and the purchase of the ‘right’ policy limits (often driven by the financial responsibility requires in the state, credentialing requirements, legal/tort environment).”

Native Video Player

Physician Malpractice Premiums Vary by State, Specialty & Other Factors

YouTube Video Player

Geography

Geography has a major impact on malpractice premiums. We reviewed 254 real neurosurgery malpractice premium rates for the exact same claims-made liability coverage in 20 states and the District of Columbia. Malpractice premiums for the exact same coverage varied over 1,300% across these 21 markets. Neurosurgeons in parts of New York and Illinois pay over 10 times more for their coverage than their counterparts in some parts of Minnesota and Tennessee. Premiums for the same coverage varied up to 300% within different parts of New York State alone.

Given these large geographic differences, it goes without saying that the national median malpractice expenses reported by medical association surveys, like AMGA, are not reliable business statistics. This can come into play when hospitals contract with independent physicians for coverage. Using the raw neurosurgery data from our sample, the impact of malpractice premiums on hourly compensation for independent neurosurgeons contracted under Professional Service Arrangements (PSAs) can vary from $15 to $225 per hour.

Malpractice insurance carriers tended to rate premiums in more specific geographic areas than Medicare’s reimbursement system recognizes. Some Ohio insurance carriers distinguish between seven (7) different sets of premium rates within the state based on counties. Medicare only recognizes one single Geographic Practice Cost Index (GPCI) malpractice rate adjustment for providers in the whole state of Ohio.

Specialty Classifications & Scope of Practice

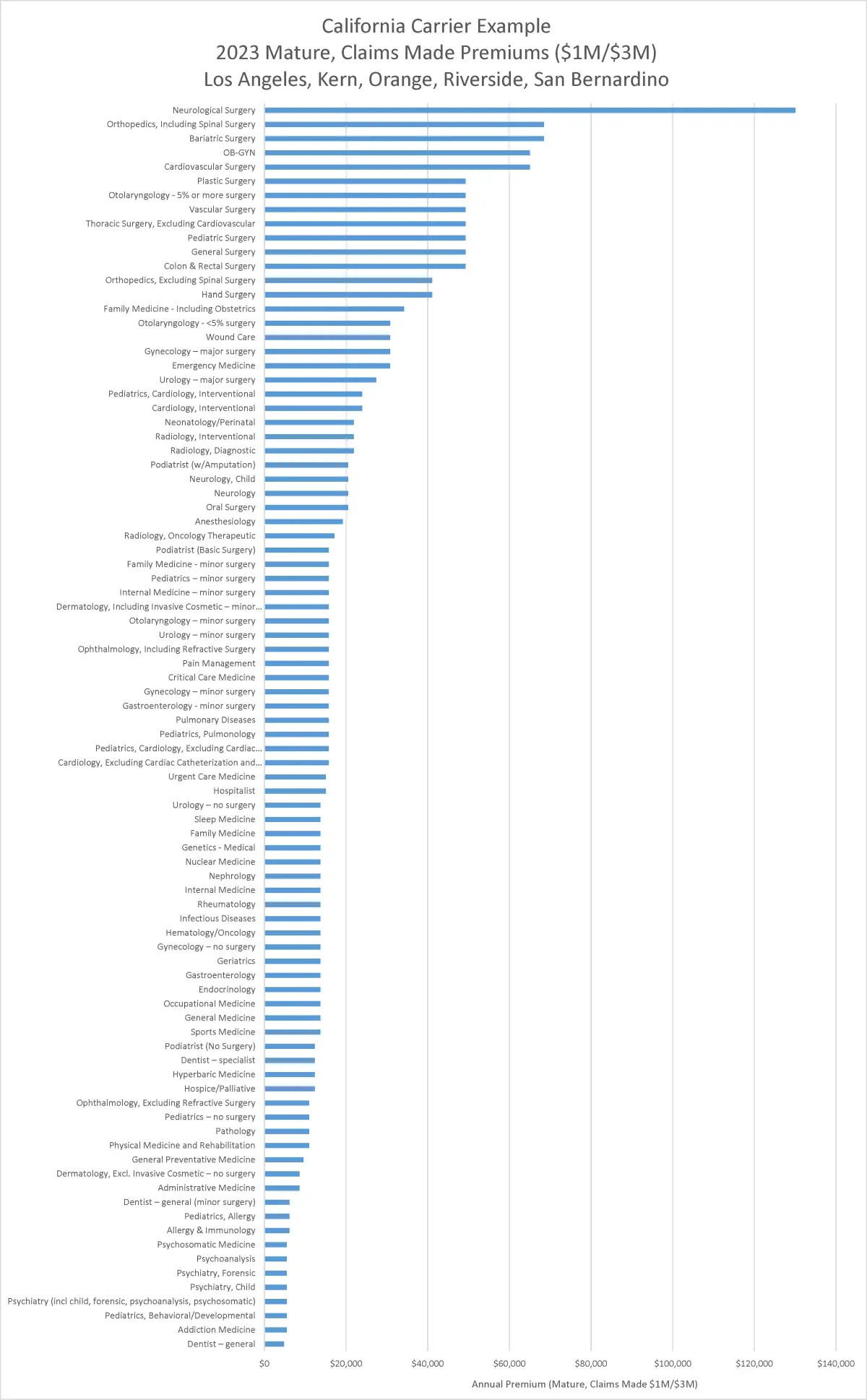

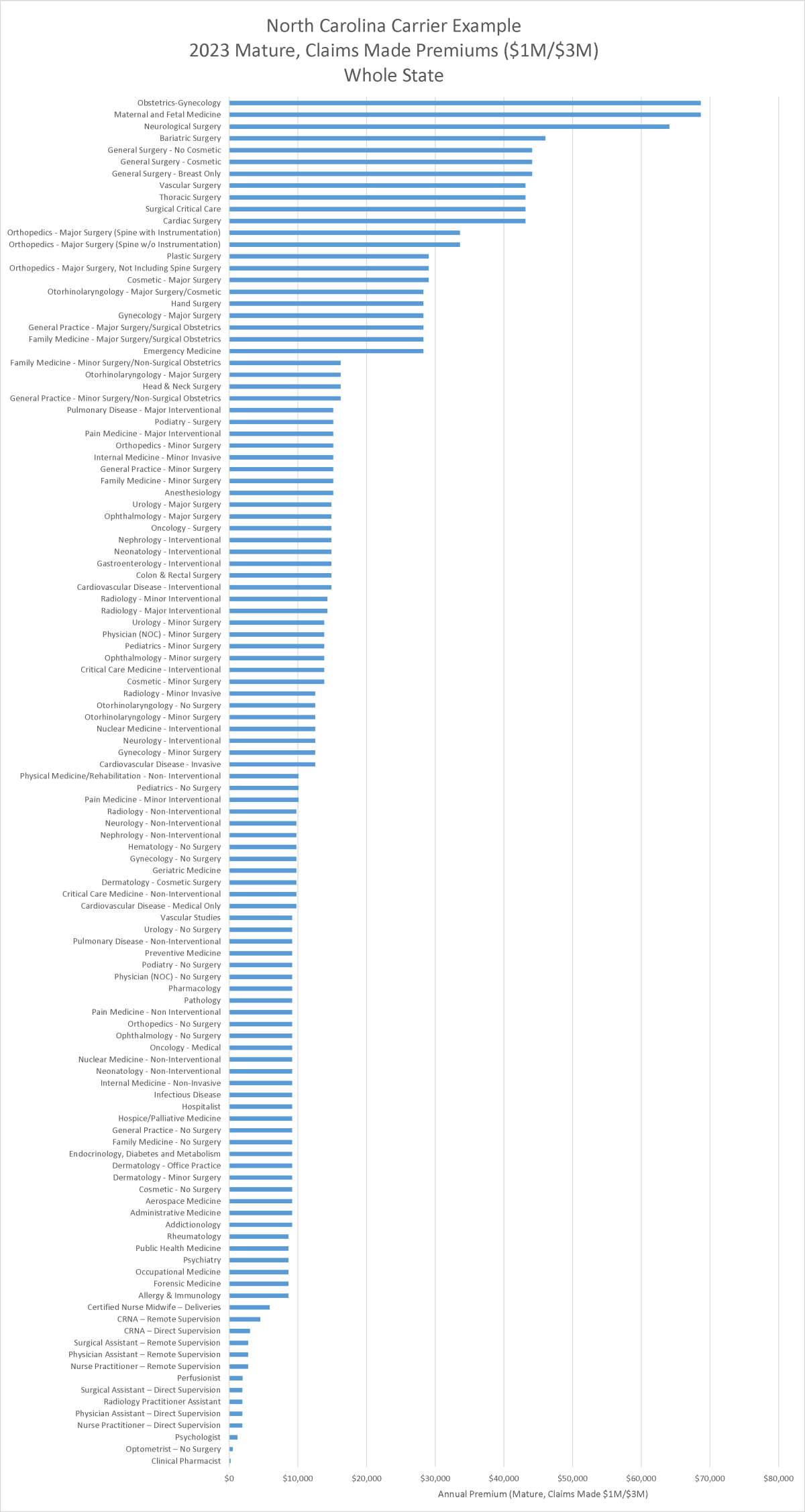

Many malpractice insurance carriers group specialties into premium rate classes. Carriers may group specialties into 10 to 30 premium classes with one to 12 specialties in each class.

Across all specialties, carriers nearly always assign the highest premiums to physicians who perform major surgery. Physicians in the same specialty who only perform minor surgery have relatively lower premiums, and specialists who do not perform surgery have the lowest premiums.

Across states, neurosurgery and bariatric surgery usually top the list of the highest premiums across all carriers. Orthopaedic spine surgery, OB/GYN, trauma surgery, cardiothoracic surgery, and general surgery usually follow. Pain management specialists performing advanced procedures also rank at or near the top of the list for carriers in some states, like Texas and Mississippi, but not others.

Psychiatry, occupational medicine, allergists, and specialists who do not perform surgery tend to have the lowest malpractice premiums among physicians.

Malpractice insurance carriers in different states rate specialties differently. For example, the California malpractice carrier below assigns far more risk, and higher premiums, to neurosurgery than other specialties. The North Carolina malpractice carrier below ranks OB/GYN and maternal-and fetal medicine higher than neurosurgery in terms of malpractice premium rates. In other states, some carriers assign the highest risk and premiums to bariatric surgery, trauma surgery, or pain management physicians who perform advanced procedures.

Occurrence vs. Claims-Made Coverage

Claims-made coverage provides coverage for claims that are both made and reported during the policy period. This means that an incident must occur and the claim must be reported to the insurance company while the policy is in effect. To maintain coverage for incidents that occurred in previous policy periods, policyholders must continuously renew their claims-made policy and may need to purchase extended reporting period coverage (tail coverage) when canceling or switching policies.

With occurrence coverage, the policy covers claims based on when the alleged malpractice occurred. In other words, the policy that was in effect at the time the incident took place will respond to any claims, even if the claim is filed years later. Once an occurrence policy is in place, coverage continues indefinitely for any incidents that happened during the policy period, even if the policy is canceled or not renewed in the future.

Question: How common is claims-made coverage compared to occurrence?

“Claims-made policies still dominate the landscape for medical liability policies, but several insurance carriers do offer occurrence-based coverage – they might be limited by jurisdiction, specialty, or policy limits. Occurrence is not as common in the hospital/facility space.”

Claims-made policies are less expensive during the first five to eight years of coverage before they reach the full mature rate. The first year of a claims-made policy might have premiums that are only 20% to 40% of the full mature rate. This is because the likelihood of a claim being made during the first year is relatively low, but the likelihood of a claim increases the longer the policy is in effect.

The mature claims-made rate is the full rate after the five to eight years of premium rate ramp-up is complete.

New York Example: Claims-Made Premium as % of Occurrence Rate

- Year 1: 31%

- Year 2: 64%

- Year 3: 85%

- Year 4: 94%

- Year 5: 99%

- Year 6: 102%

- Year 7: 104%

- 8 or more: 105%

California Example: Claims-Made Premium Ramp-Up to Mature Rate:

- Year 1: 35%

- Year 2: 65%

- Year 3: 80%

- Year 4: 90%

- Year 5: 100%

Extended Reporting Period Coverage (Tail Coverage)

When a physician employee leaves a medical group with a claims-made coverage policy, the physician becomes vulnerable to legal claims related to incidents that occurred before his or her policy was cancelled.

Extended reporting period coverage (tail coverage) is expensive, but it can protect physicians from claims that occur after their claims-made policy is cancelled.

Depending on how long the physician was employed at his or her previous employer, the one-time lump sum cost to get tail coverage could be 200% of the annual premium under the cancelled policy. We reviewed tail coverage rates for 30 insurance carriers across nine states. The most common tail rate factor was 200% for physicians who had been covered at least 3 years under the cancelled policy.

Tail Coverage Rate Factors (Years Since Retro Active Date) (n=30)

| wdt_ID | Benchmark | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 |

|---|---|---|---|---|---|---|

| 1 | 25th Percentile | 81 | 126 | 150 | 164 | 171 |

| 2 | 50th Percentile | 94 | 155 | 173 | 188 | 188 |

| 3 | 75th Percentile | 135 | 170 | 187 | 200 | 200 |

| 4 | Average | 111 | 152 | 168 | 179 | 181 |

| 5 | Mode | 95 | 160 | 200 | 200 | 200 |

For example, if annual malpractice premiums for a neurosurgeon were $100,000 per year under a standard claims-made policy, then the one-time cost for tail coverage could be a $200,000 lump sum payment. This is a large expense for an individual physician.

Question: When a physician moves from one medical group to another, who most often pays for tail insurance to cover claims resulting from services provided at the physician’s old job?

“We see this a number of ways and it is largely driven by the contract signed upon employment and the structure of the policy. It is more common for a physician covered by a large hospital program to continue to have reporting rights while they were employed by that facility. Physicians with individual limits should identify and address how their tail coverage will be handled upon departure from their medical practice or employment situation. The employment contract might dictate that tail will be purchased if employed for a set number of years, or if the relationship is terminated prior to that, then the physician bears the responsibility. It’s a key point during employment negotiations given the potential large expense of tail coverage – the new employer can sometimes pay the cost of the prior tail as a way to entice a new provider to join.

In lieu of purchasing tail coverage, a provider may request that the new policy assume the existing retroactive date (referred to as “prior acts” or “extended reporting period coverage”), therefore any claims reported later would be covered by the new carrier.”

—Janel Loud-Mahany, Sr. Vice President, COPIC

"In lieu of purchasing tail coverage, a provider may request that the new policy assume the existing retroactive date (referred to as “prior acts” or “extended reporting period coverage”), therefore any claims reported later would be covered by the new carrier."

Tail coverage is most often purchased from the same carrier that underwrote the original policy, however some carriers do offer standalone tail coverage policies. According to Janel, if the same malpractice carrier covers both the prior and new employer, the physician may not need tail coverage.

Carriers like COPIC may also elect to pick up prior acts on new policies. Although carriers may be willing to pick up prior acts, any claims will impact the new employer’s claims experience. The new employer may prefer to just pay for tail coverage to keep their claims history clean.

Group Size & Deductibles

Question: Are malpractice premiums typically much lower for a physician in a big group compared to the same physician working as an independent contractor? Do big groups usually agree to higher deductibles than independent practices?

“Generally speaking, there can be additional discounts on group accounts compared to a policy for a solo doctor, which can be offered for several reasons. There is administrative ease for the carrier (single billing, typically a single primary contact, one quote, etc.), and because of group size, there can be some economies of scale in delivering services and greater credibility in the loss experience and ability to rate a large account. A single loss for a doctor can wipe out their premium collected for a decade, whereas a single loss within a group can be absorbed by the premium of other physicians who don’t have claims.

As noted previously, carriers can offer various deductible options in exchange for premium credits. Most individual deductibles would start at $5,000 per claim. The comfort of the physician with various risk sharing options and their ability to meet the deductible liability (if needed) influences whether a deductible is obtained,” says Janel. “Unlike most automobile policies, the majority of standard MPL policies do not automatically come with a deductible attached and this is typically elected as a way to reduce premium costs. Deductibles are more common within group practice because they can financially withstand the deductible obligation and they are inclined to take on more risk (higher deductibles) to control their medical liability insurance expenses.”

"...the majority of standard MPL policies do not automatically come with a deductible attached and this is typically elected as a way to reduce premium costs."

Advanced Practice Providers (APPs) & Other Professionals

Malpractice insurance carriers tend to calculate premiums for APPs at a percentage of premiums for related physician specialties. According to our national review, premiums for nurse practitioners and physician assistants may range from 8% to 40% of premiums for family medicine physicians, depending on whether they work under physician supervision and whether they share liability limits or have separate limits.

Certified Registered Nurse Anesthetist (CRNA) premiums range from 18% to 35% of anesthesiologist premiums, depending on whether they work under physician supervision and whether they share liability limits or have separate limits.

Question: Are nurse practitioners and physician assistants in medical groups most often sharing liability limits with physicians or do they usually have their own separate liability limits?

“When employed, advanced practice providers (APPs) primarily share in the limits of their employer, however, as changes occur to scope of practice, and as they pursue outside activities, there has been an increase in the number of standalone policies issued to APPs. Several carriers have expanded their coverage offering over the last 12-24 months, rolling out programs designed for APPs. There has been the sentiment that APPs will continue to have expanding roles in healthcare delivery and filling many of the primary care shortage needs seen across states. Many carriers are offering policies or preparing to do so.”

Telemedicine & Malpractice Coverage

Question: How does coverage for telemedicine services work? Do medical professionals need to purchase a malpractice policy in every state where their telemedicine patients reside?

“It depends. Nearly all policies have exclusions for services provided where the physician is not properly licensed. Where the patient is located when the care and treatment is provided is where the practice of medicine occurred, and where the patient would likely file a claim – a view held by carriers in the industry. Therefore, the policy should be carefully examined for any territorial restrictions and limitations with respects to licensure. It’s always important for providers to inform their medical liability carrier of a change in practice locations, including telemedicine activities, so that an assessment can be made and any policy changes addressed. For example, working in another state may require that different limits of liability are required to meet the financial responsibility of that state, or the carrier may view a change of location/venue as riskier and want to make a premium adjustment. Carriers, including COPIC, typically offer resources and details to help our insureds navigate a telemedicine practice.

Another consideration and reason to inform your carrier about out-of-state practice is for any PCF’s (Patient Compensation Funds) that might afford additional limits and protections for physicians within certain states (KS and NE have PCF’s for example).”

—Janel Loud-Mahany, Sr. Vice President, COPIC

Malpractice Impact on Fair Market Value PSA Compensation

Independent physician practice is still widespread in big states like California, Texas, and New York where corporations are prohibited from employing physicians directly. Hospitals and health systems in these Corporate Practice of Medicine (CPOM) states commonly use Professional Service Arrangements (PSAs) to secure independent physician services.

Malpractice insurance premiums are a major expense of physician practices that should be factored into Fair Market Value analysis of PSA arrangements. Simply relying on median statistics from national association surveys does not account for the +1,000% variation in malpractice premiums across U.S. markets.

Health-Contract.com has conducted extensive research on a sample of over 30,000 real malpractice insurance rates across the U.S.

Our DataRise™ Malpractice Expenses by State & Specialty subscription will be available on or before March 31, 2024. Pre-order by March 29th and save $3,000 with discount code: malpractice3000

We have the data!

The DataRise™ Malpractice Expense by State and Specialty subscription is the most robust and authoritative source of malpractice premium costs.

Pre-order the subscription by March 29th and save $3,000 with discount code malpractice3000, or contact Health-Contract.com directly.

Have a question for Janel?

Janel Loud-Mahany, MBA, AINS, AIS

COPIC – Sr. Vice President of Underwriting & Policyholder Services

Operational Council Member

Phone: 720-858-6168

Email: jloud@copic.com

Have a question for Nick?

Nicholas Newsad, MHSA

Author of Doctor Deals

Phone: 303-993-5333

Email: nnewsad@cokergroup.com

We have the data!

The DataRise™ Malpractice Expense by State & Specialty data subscription includes 47,000 real malpractice premium rates for over 100 specialties across 49 U.S. states and D.C.

Purchase the data subscription today, or contact Coker directly.