Highest 2024 Hospital Fees Signal New Trend

The most highly reimbursed hospital service during 2024 is the first of a whole new class of treatments. Chimeric Antigen Receptor (“CAR”) T-cell therapy tops the 2024 list, but an even more expensive hospital treatment just hit the market.

Native Video Player

Highest 2024 Hospital Fees Signal New Trend

YouTube Video Player

CAR T-cell therapy has surpassed heart transplant and extensive burn treatment as the most highly reimbursed inpatient hospital service. Using the DataRise™ Commercial Reimbursement Data set, we verified that commercial reimbursement for CAR T-cell therapy far surpasses all other hospital inpatient services across over a dozen hospitals in the greater Denver, Colorado market. Across three different commercial insurance carriers, the average price for CAR T-cell therapy is about $820,000.

CAR T-cell therapy is an advanced cancer treatment that modifies a patient’s own T-cells to express chimeric antigen receptors (“CARs”), allowing them to recognize and attack cancer cells more effectively. The FDA approved the first CAR T-cell therapy, Kymriah (from Novartis), in 2017 for treating certain types of leukemia. Yescarta, developed by Kite Pharma (a Gilead company), was also FDA-approved later in 2017 for specific types of lymphoma. These therapies represent breakthroughs in immunotherapy, offering new options for patients with certain relapsed or refractory cancers.

Highest 2024 Hospital Fees (Colorado, 3 Commercial Carriers)

| Health_Plan | Hospital | DRG | Service | Negotiated_Rate |

|---|---|---|---|---|

| UHC Choice Plus CO | University of Colorado Hospital Authority | 0018 | Chimeric Antigen Receptor (CAR) T-Cell Immunotherapy | 949,958 |

| UHC Choice Plus CO | University of Colorado Hospital Authority | 0001 | Heart Transplant | 709,540 |

| UHC Choice Plus CO | University of Colorado Hospital Authority | 0927 | Extensive Burns w/Graft | 597,602 |

| UHC Choice Plus CO | Denver Health & Hospital Authority | 0018 | Chimeric Antigen Receptor (CAR) T-Cell Immunotherapy | 1,105,020 |

| UHC Choice Plus CO | Denver Health & Hospital Authority | 0001 | Heart Transplant | 812,768 |

| UHC Choice Plus CO | Denver Health & Hospital Authority | 0927 | Extensive Burns w/Graft | 790,577 |

| UHC Choice Plus CO | Intermountain (St. Jo, Good Sam, Westminster) | 0018 | Chimeric Antigen Receptor (CAR) T-Cell Immunotherapy | 786,444 |

| UHC Choice Plus CO | Intermountain (St. Jo, Good Sam, Westminster) | 0001 | Heart Transplant | 587,410 |

| UHC Choice Plus CO | Intermountain (St. Jo, Good Sam, Westminster) | 0927 | Extensive Burns w/Graft | 494,738 |

| Cigna Connect CO | Medical Center of the Rockies | 0018 | Chimeric Antigen Receptor (CAR) T-Cell Immunotherapy | 859,872 |

| Cigna Connect CO | Medical Center of the Rockies | 0001 | Heart Transplant | 632,454 |

| Cigna Connect CO | Medical Center of the Rockies | 0927 | Extensive Burns w/Graft | 615,186 |

| Cigna Connect CO | UC Greeley | 0018 | Chimeric Antigen Receptor (CAR) T-Cell Immunotherapy | 796,650 |

| Cigna Connect CO | UC Greeley | 0001 | Heart Transplant | 585,953 |

| Cigna Connect CO | UC Greeley | 0927 | Extensive Burns w/Graft | 569,954 |

| Cigna Connect CO | Boulder Community Health | 0018 | Chimeric Antigen Receptor (CAR) T-Cell Immunotherapy | 516,708 |

| Cigna Connect CO | Boulder Community Health | 0001 | Heart Transplant | 380,050 |

| Cigna Connect CO | Boulder Community Health | 0927 | Extensive Burns w/Graft | 369,673 |

| Aetna (Arrow Electronics Plan) | CommonSpirit (CHI)/Centura | 0018 | Chimeric Antigen Receptor (CAR) T-Cell Immunotherapy | 562,293 |

| Aetna (Arrow Electronics Plan) | CommonSpirit (CHI)/Centura | 0001 | Heart Transplant | 413,579 |

| Aetna (Arrow Electronics Plan) | CommonSpirit (CHI)/Centura | 0927 | Extensive Burns w/Graft | 402,286 |

| Aetna (Arrow Electronics Plan) | UC Health Broomfield, Highlands Ranch | 0018 | Chimeric Antigen Receptor (CAR) T-Cell Immunotherapy | 988,748 |

| Aetna (Arrow Electronics Plan) | UC Health Broomfield, Highlands Ranch | 0001 | Heart Transplant | 727,245 |

| Aetna (Arrow Electronics Plan) | UC Health Broomfield, Highlands Ranch | 0927 | Extensive Burns w/Graft | 707,388 |

| Aetna (Arrow Electronics Plan) | Boulder Community Health | 0018 | Chimeric Antigen Receptor (CAR) T-Cell Immunotherapy | 830,250 |

| Aetna (Arrow Electronics Plan) | Boulder Community Health | 0001 | Heart Transplant | 610,667 |

| Aetna (Arrow Electronics Plan) | Boulder Community Health | 0927 | Extensive Burns w/Graft | 593,993 |

Since FDA approval only seven years ago during 2017, CAR T-cell therapy quickly escalated to become the most expensive hospital service reimbursed by commercial insurance carriers.

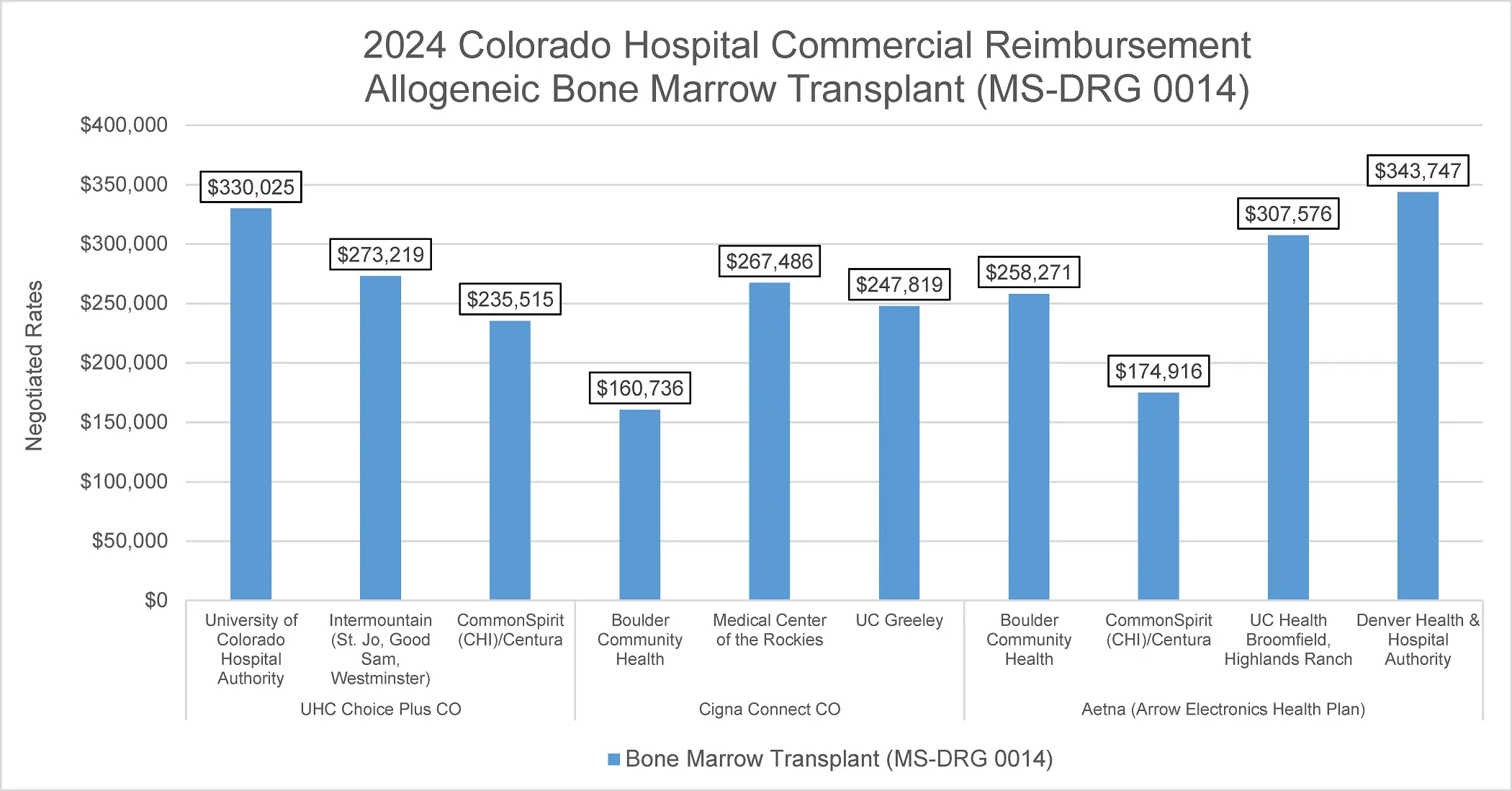

This trend highlights hospitals’ reliance on hematology-oncology physicians for two of their most highly reimbursed hospital services. In addition to CAR T-cell therapy, bone marrow transplant (“BMT”) is already among the top ten most highly reimbursed inpatient services at most hospitals.

Even more cell therapy and gene therapy hospital services will be here soon.

At the end of last year, the FDA approved two new gene therapies to treat sickle cell disease. These two new treatment include Vertex Pharmaceutical’s Casgevy and Bluebird Bio.’s Lyfgenia. Drug companies and doctors don’t like using the word “cure”, but these treatments are probably as close to a “cure” for sickle cell disease as we are likely to get.

The word on the street is that the price for Casgevy is $2.2 million while its counterpart, Lyfgenia, is priced at $3.1 million. During the next 12 to 18 months, Casgevy and Lyfgenia will leapfrog CAR T-cell therapy as the most expensive hospital treatments nationwide.

Once the new reimbursement contracts are in place, hematologists and oncologists will be responsible for administering three of the top ten most expensive inpatient hospital treatments.

BMT has been around for a while, but cell therapy and gene therapy treatments are emerging fields. At the time of this blog post, the American Board of Medical Specialties does not yet recognize any of the independent board certifications for regenerative medicine or stem cell physicians. This means healthcare business professionals are working in a vacuum to figure out Fair Market Value compensation for physicians providing these services.

DataRise™ Provider Compensation Data, DataRise™ Commercial Reimbursement Data, and DataRise™ Not-for-Profit Compensation Data, are all excellent tools for compensation folks working with these specialties. Contact Health-Contract.com today to learn how to incorporate these tools into your FMV analyses.